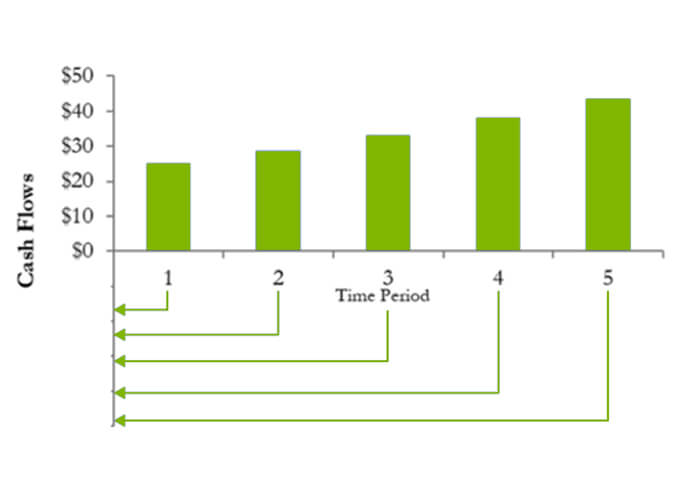

Present discounted value is the discounted value of a future cash flow stream.

Time value of money implies that a dollar now is worth more than a dollar in the future because of its earning potential in the time between the present and the future. That current dollar can be deposited into an interest-bearing account or invested in some other asset to earn a rate of return.

Present value refers to the dollar value of a cash flow stream at this exact moment. This current valuation is normally used in the calculation of a future valuation of that cash flow stream.