Diversification in finance is the practice of spreading out a portfolio's assets between a wide array of investment types in order to decrease risk.

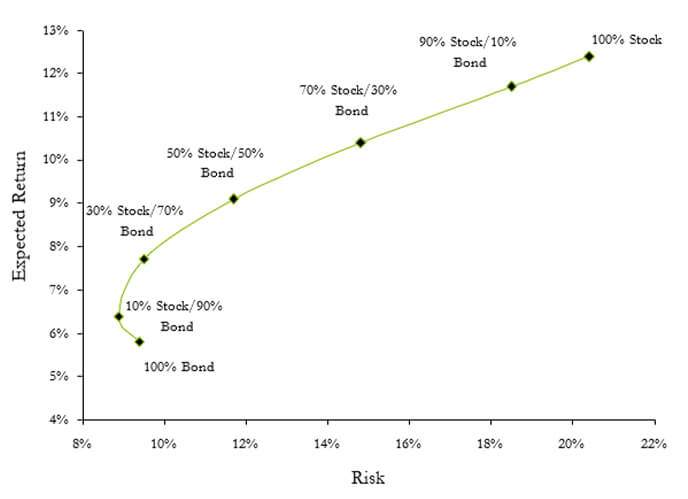

Stocks, bonds, and cash have different risk/return profiles.

Allocating part of the assets to each of these asset classes can help minimize risk for a given level of desired returns.

Competition in the financial markets reduces expected returns to the point where expected returns compensate investors for the security's risks after including the security in a well-diversified portfolio.

Modern portfolio theory classifies risk into two categories:

Owning shares in an established company carries a much lower risk than owning shares of a startup company. That risk-level difference can be related to both maturity and industry. The typical investor would require a higher expected return to feel comfortable investing in a start-up company due to the increased risk. The market compensating investors through higher returns to offset the added risk is an example of compensated risk.

Uncompensated risk is the risk that is taken on by an investor that is not compensated for. For example, nobody will pay an investor for holding too few stocks: an investor who held a portfolio concentrated in internet stocks in early 2000 suffered losses with the dot-com bubble that drove prices of internet companies downward from 2000 to 2002. This investor's concentrated portfolio was running a risk that could have been reduced had they balanced their exposure to internet stocks with exposure to other industries.

Investing in a combination of asset classes helps reduce the risk of investment loss.

In 2008, investing 100% of a portfolio in the 500 largest US companies would have resulted in a 40% loss. During the same time period, investing in a mix of corporate and government bonds would have resulted in a gain of around 5%.

Balanced exposure to the different asset classes can reduce risk while maintaining a desired level of returns.