Credit rating evaluates a borrower's credit capacity, assesses their ability to pay back debt, and predicts the likelihood of default. Its subject can be either an individual, a company, a specific security, or a government.

Credit score, which ranges from 300-850, is a numeric rating system created by FICO that measures an individual's credit worthiness. It is calculated by the credit bureau or consumer credit reporting agency based on one's credit history and other related factors.

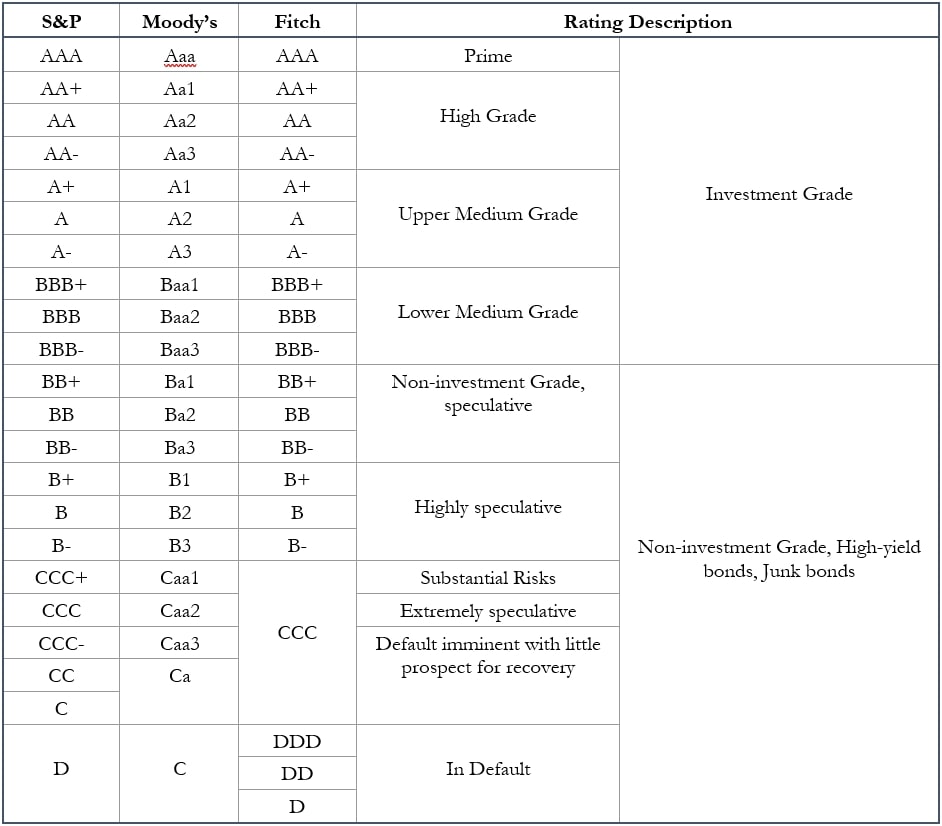

Unlike personal credit scores, credit rating agencies usually assign letter grade ratings.

Sovereign credit rating assesses the creditworthiness of a country or sovereign entity based on its economic and political environment. The rating can give investors insights into the risk level of investing in a certain country's securities, taking into account any political risk. A good sovereign credit rating could help developing countries attract foreign direct investment in international bond markets.

Short-term credit rating predicts the probability of a borrower defaulting in a year or less, whereas long-term credit rating predicts the probability of a borrower defaulting within any given time frame.

Corporate credit rating, or bond rating, is assigned to individual companies and to securities, including preferred stock, corporate bonds, or other debt securities. Three agencies, Moody's, S&P Global, and Fitch Ratings, control 95% of the credit rating market which makes the industry extremely concentrated. These companies evaluate the risk of default and provide a reliable indicator for potential investors.

Above is a chart detailing bond ratings from best rated to worst rated. Purchasing a bond that is investment grade is considered safe while purchasing a non-investment grade bond is considered risky. The non-investment grade bonds may stop paying coupons and go into default which will cause the investor to lose a lot of money.