Churning is excessive trading in a customer's account by a broker in order to generate commissions without taking the client's investment objectives into account. Churning is illegal and may result in significant losses in the client's account.

Turnover and cost-to-equity ratios are the two common indicators of alleged excessive trading in churning cases. Both ratios are flawed and should not solely be used to evaluate the existence of churning.

Turnover ratios measure how often the securities in a customer's account are traded in a year. It is calculated by dividing the total security purchases by the average equity balance and then dividing it by the number of years covered in the analysis. Usually, a turnover ratio of 4:6 or higher indicates that there may be churning, although it may also occur at lower ratios. Comparing turnover ratios of an account to the average turnover ratio of similar accounts is more accountable proof.

Cost-to-equity ratios measure the percentage of annual trading cost taken in the customer's total investments. A cost-to-equity ratio of 15-20% or more can indicate possible churning.

Churning requires three elements:

Trading in the account was excessive and was not in the client's best interest. This includes excessive in-and-out trading that buys and sells the same security repeatedly.

To prove churning, we need to ensure the broker has control over the trading activity of the account. This control can be either direct or indirect control in any manner. Even in cases where the broker has non-discretionary authority (the broker must run decisions by the client before making investment decisions), there can still be proof of churning through solicited trades. Solicited trades are ones where the broker recommends certain investments to the client, and unsolicited trades are ones where the client asks for certain investments.

There should be proof that the broker either has the intent to defraud or willfully disregard the investor's interest.

The SEC and FINRA both have sanctions in place to prevent brokers from churning. These regulating bodies have prohibited all forms of churning that fall under their individual definitions, and each has its own ability to punish brokers found guilty of this practice. These punishments can include legal action, large fines, suspension, or indefinite barring from practicing. Most companies and banks do not want to be associated with brokers that have engaged in churning, so it is standard that brokers found guilty are also terminated from their employers.

Investors that allow brokers to manage their portfolios can avoid churning by asserting the need to have all transactions and trades require explicit permission. This prevents brokers from making unnecessary trades and failing to disclose them. To ensure that brokers are not tempted to withhold information relating to excessive trading, investors can establish a fee-based trading agreement with their broker. Another way to prevent churning is to regularly review financial statements from accounts under the partial or full control of a broker.

Was there a reasonable expectation at the time of the trading that the client would benefit from the trading?

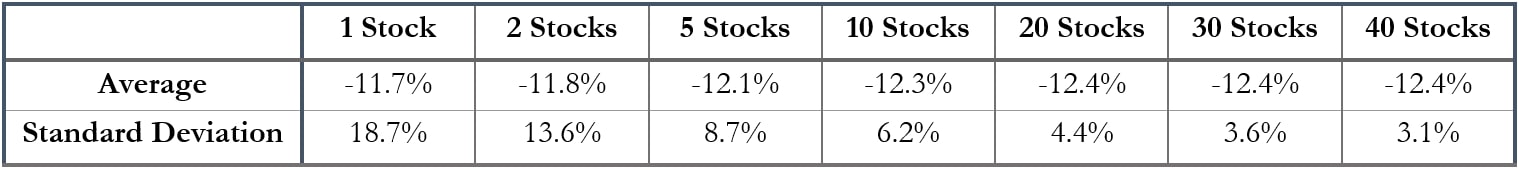

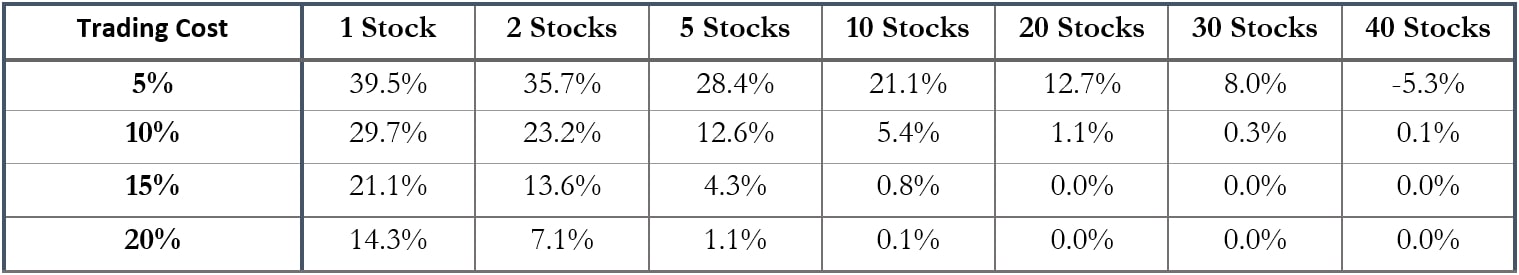

Once an account's assets are invested, returns from subsequent trades must be projected to sufficiently cover the costs incurred in previous trades.

The correct analysis must include recognition that the costs of trading should be assessed in light of the changes in the risk and likely returns in the portfolio at different points in time.

Most allegedly churned accounts hold a lot of securities and have similar securities being bought and sold. In these cases, the probability of covering even 5% per year in trading costs is low.

A broker can engage in reverse churning when they are paid a flat fee for managing an investment portfolio. The broker can be paid upfront and then does not do any trading to earn the flat fee.

Insurance salespeople who work on commission are able to increase their compensation by persuading customers to switch to more expensive and comprehensive policies. This is considered churning when the practice is done with the intent to deceive customers or sell them policies they do not need and will not use.

Investors can open multiple credit card accounts to receive the initial rewards and then close those accounts without using them or using them very briefly. This practice is not directly illegal, but many credit card companies track individuals that engage in these practices and attempt to stop them from being able to open further accounts.